Executive Summary

Through this article, I dive deep into chain abstraction and how Particle Network is tackling some of the biggest challenges with interoperating between multiple chains.

Consider this article as my thesis for the extended chain abstraction vertical.

My main thesis behind Chain Abstraction is based on two key assumptions:

-

The likelihood of hundreds, if not thousands, of L1s and L2s coexisting on-chain.

-

The critical importance of user attention in driving demand and shaping behaviors in the crypto space.

And given the assumptions, I believe the primary drivers for chain abstraction are:

-

The higher cost of capital resulting from fragmented liquidity across multiple chains.

-

The opportunity cost of capital sitting idle in these fragmented pools.

The main focus is on Particle Network’s approach, which is broken down into its key components: Universal Accounts, Universal Liquidity, and Universal Gas.

Throughout the article, I have used some real-world examples and analogies to make the concepts more relatable. It strikes a good balance by highlighting both the benefits and potential challenges of chain abstraction.

Introduction

Chain Abstraction can be understood in many ways, but at its core, it's about one simple idea: creating a system where users can express what they want (their intent) without needing to worry about the complex processes working behind the scenes to make it happen.

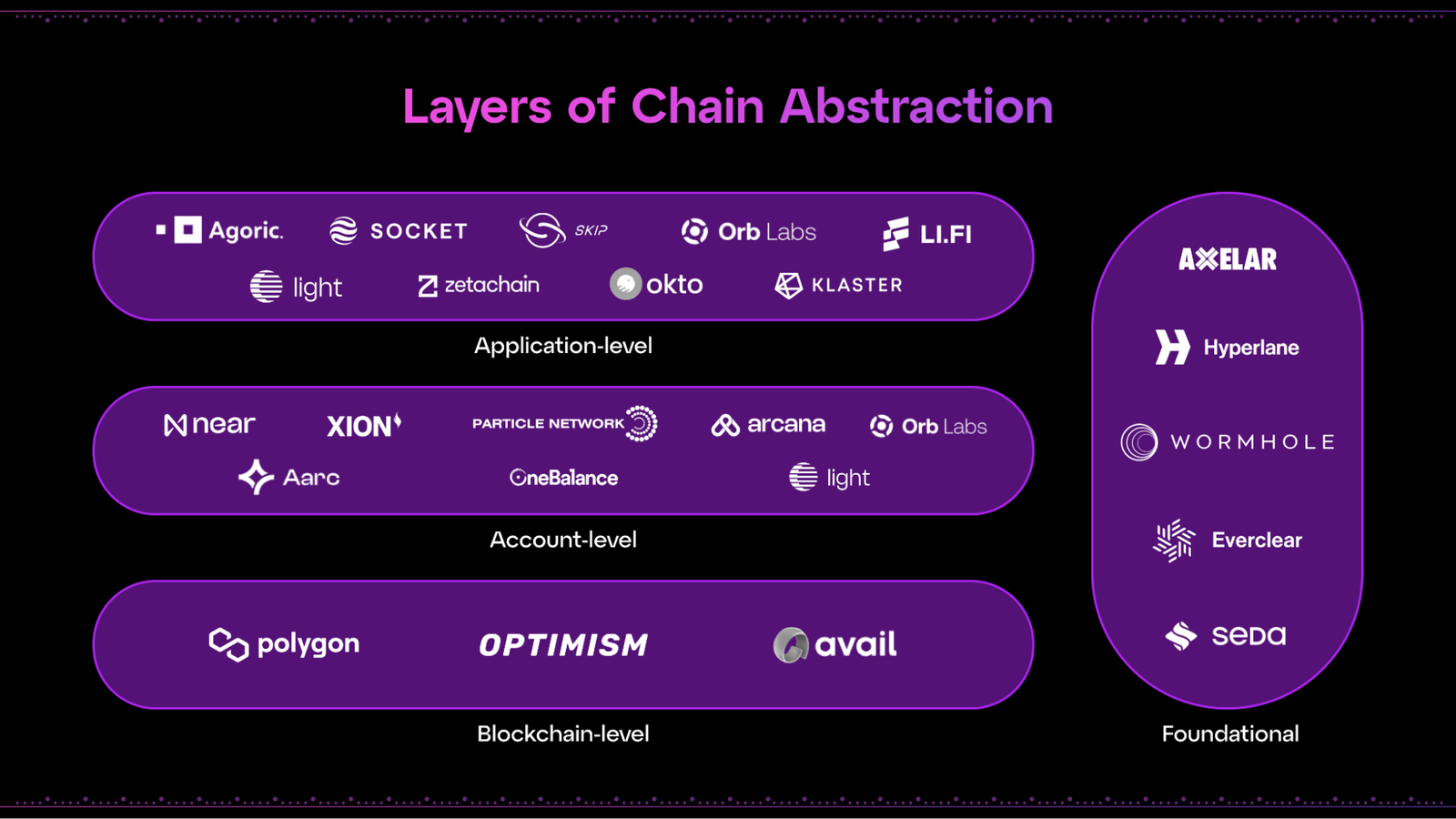

There’s been enough narratives running around for chain abstraction, and there are several layers to be executed on the chain abstraction layer stack—Account level, blockchain level, and application level.

As we dive deeper into the ongoing debate—whether to focus more on infrastructure or applications—we’re faced with an emblematic challenge that impacts both: finding the right balance between foundational development and practical implementation.

In today’s ecosystem, we’re in a pivotal phase where the primary focus is on solving key technical challenges rather than chasing immediate monetization. Builders on both sides of the debate are more concerned with simply “making it work” than worrying about where the value will eventually be extracted—and I personally believe that this is the right approach.

The emphasis on solving core technical issues before focusing on monetization is reminiscent of the internet's early days. Just as early internet pioneers prioritized functionality over profit, blockchain builders today are prioritizing the creation of robust, efficient systems that can support the next generation of decentralized applications.

Imagine if your favorite e-commerce websites only accepted payments from a single bank (let’s say Base L2) and only in one currency (ETH instead of SOL, BTC, BNB). On top of that, there’s no option for international shipping. This scenario would significantly limit the reach and usefulness of these platforms, much like how the current fragmented blockchain ecosystem limits the potential of decentralized applications. Just as we expect seamless international transactions and shipping in e-commerce, blockchain users should also be able to interact with different networks and protocols without any friction.

At present, users' assets are fragmented across multiple chains. This fragmentation restricts their ability to fully access and take advantage of the wide range of opportunities available across different ecosystems, DeFi in Arbitrum, Gaming in AVAX, Memecoin mania within base, and much more. And because of this, developers are incentivized to either create simple applications that can be easily deployed across multiple chains and capture value from siloed userbases, or to focus intensely on a niche within a single ecosystem. This is because users are effectively siloed within the ecosystems where they hold assets, as moving between chains is complex and costly.

Chain abstraction is a perfect solution for this. Chain abstraction introduces an intermediary layer between blockchain infrastructure and applications. Chain abstraction simplifies blockchain interactions by creating a unified layer between infrastructure and applications. It allows users to have one address and a universal balance across all networks, eliminating the need to manage different blockchains. This seamless, chain-agnostic experience removes complexity, supporting robust infrastructure and user-friendly applications, and could accelerate the mainstream adoption of blockchain technology.

This is why I’ll be looking into Particle Network, one of the main organizations pushing chain abstraction, more in detail as you read through this research article.

Challenges

As more and more L1s and L2 solutions start emerging to address specific challenges and use cases, the more complex the ecosystem has become. For example,

Berachain with its Proof-of-Liquidity focuses on incentivizing liquidity provision, making it ideal for DeFi use cases within it, for which they have built a loyal community around it as well. Interestingly, the 7 out of top 10 NFT projects on Arbitrum are Berachain focused projects waiting to migrate before Berachain mainnet goes live.

Arbitrum has stood the test of time among its peers within Ethereum L2 in the DeFi space by beating its peers with the highest TVL. With ZKsync sitting at the lowest amongst its well funded peers.

Meanwhile, Base has found its niche with memecoins amid the farcaster bullrun and also contributed by the ongoing Coinbase-SEC lawsuit.

Avalanche has gained popularity in the gaming dApp space, largely due to its subnets, which offer fast transactions and low fees. On-chain games demand cheap and quick transactions, even during periods of high demand, and Avalanche's subnets provide just that. With subnets, developers can easily create their own fully customized Avalanche blockchain tailored specifically for their game or gaming ecosystem.

And, Solana has had a rapid growth over the past year. With an impressive 580% growth, far outpacing Bitcoin’s 120%+ and Ethereum’s 66%, Solana has become a hotspot for memecoin activity (outside Ethereum), driving high growth in total fees, DEX volumes, and new token launches (with pump.fun).

+ 100 more chains that exist have their own community, specialized use cases, and/or mission/vision.

While these chains offer performance benefits, they also introduce significant complexity, mainly around:

-

Fragmented Liquidity: With liquidity scattered across chains that specialize in DeFi, gaming, or memecoins, it becomes tough to efficiently allocate capital. This fragmentation results in less competitive rates for users and makes the market less efficient. For protocols, managing liquidity across all these different chains is not only expensive but also complex, with the need for cross-chain transfers adding costs and exposing users to additional risks.

-

Complex user experience: This multi-chain setup also complicates the user experience. Managing assets becomes tricky when you’re dealing with multiple wallets, interfaces, and token standards across different networks. On top of that, understanding and handling gas fees on various chains just adds another layer of complexity, making the learning curve steeper and slowing down the wider adoption of blockchain technology.

To move assets from one chain to another, users typically rely on bridge services or centralized exchanges. This process can be:

-

Complex: It often involves multiple steps and requires a certain level of technical knowledge.

-

Costly: Users usually have to pay transaction fees on both the source and destination chains, along with any fees for the bridging service.

-

Time-consuming: Typical cross-chain transactions can typically take anywhere from minutes to hours to complete.

-

Risky: There’s always a risk of user error or vulnerabilities in the bridge protocols and centralized exchanges.

Impact on User Behavior: Users tend to focus their activities on the chains where they already hold assets. They are less inclined to explore or use applications on other chains if it involves going through a complex and costly process to move their assets.

Thesis Behind Chain Abstraction

My thesis behind Chain Abstraction is based on two key assumptions:

-

First, we’re likely going to see hundreds, if not thousands, of L1s and L2s coexisting on-chain.

-

Second, in the crypto space, user attention is everything. It drives demand and can shape behaviors. By creating a smoother, more engaging user experience, chain abstraction could capture and hold user attention more effectively. This could create a positive feedback loop where more attention leads to more development, which then attracts more users and capital.

Given the assumptions, the two major drivers for chain abstraction would be the

-

Higher cost of capital

-

Opportunity cost of the capital sitting idle in fragmented liquidity.

The cost of capital in this context is multifaceted and extends far beyond simple financial metrics. Each new blockchain, whether L1 or L2, needs its own liquidity to function well. This spreads users and liquidity providers thin, reducing capital efficiency. Smaller liquidity pools lead to higher slippage, increased volatility, and unstable token prices, raising the overall cost of using these networks. These effects essentially raise the cost of using these networks, as users often must pay more for certain services that are cheaper on other chains (on chains other than main chain that user uses) or accept poorer execution prices.

Managing liquidity across multiple chains also comes with significant operational costs. Users and protocols deal with gas fees for moving assets between chains, juggling multiple wallets, and tracking assets across various networks. These tasks are especially tough for smaller players, possibly stifling participation across multiple chains.

A big chunk of capital is also locked in bridge protocols for cross-chain transactions, creating both an opportunity cost and security risk. Locked capital can’t be used elsewhere, and bridges have often been targets for hacks, adding to the overall cost of capital in this fragmented blockchain world.

However, the opportunity cost of this very liquidity lying dormant or underutilized in individual L1s and L2s is perhaps even more significant and far-reaching.

-

When capital is stuck on one chain, it misses out on high-yield opportunities on others, leading to suboptimal returns. For instance, if a particularly attractive lending rate emerges on one L2, for a user, their capital confined to other chains misses out on this opportunity.

-

This fragmentation also hampers efficient market-making and reduces the potential for composability, which is key to creating more complex and profitable yield strategies. This selective approach results in some chains having less efficient markets with wider spreads and less depth.

The high costs and missed opportunities caused by fragmented liquidity really show why we need solutions that can bring everything together across different chains. This is where chain abstraction could really shake things up. If users could easily move and use their assets across all chains, protocols would no longer be just competing within their own chain’s ecosystem. Instead, they’d have to compete with every other application in the entire Web3 space. This could spark a lot of innovation because developers would need to create truly compelling and unique apps to stand out and attract users. The competition would be much tougher, but it could also lead to better and more innovative applications across the board.

Chain Abstraction Landscape & Multi-Layer Framework

Now, when you look at the landscape and specifically the projects building for chain abstraction, the best way to look at this is through the Multi-Layer Framework that was developed by Particle Network earlier in June this year.

In the simplest of terms, the multi-layer chain abstraction stack helps simplify everything from how developers build apps to how users manage their assets across different blockchains.

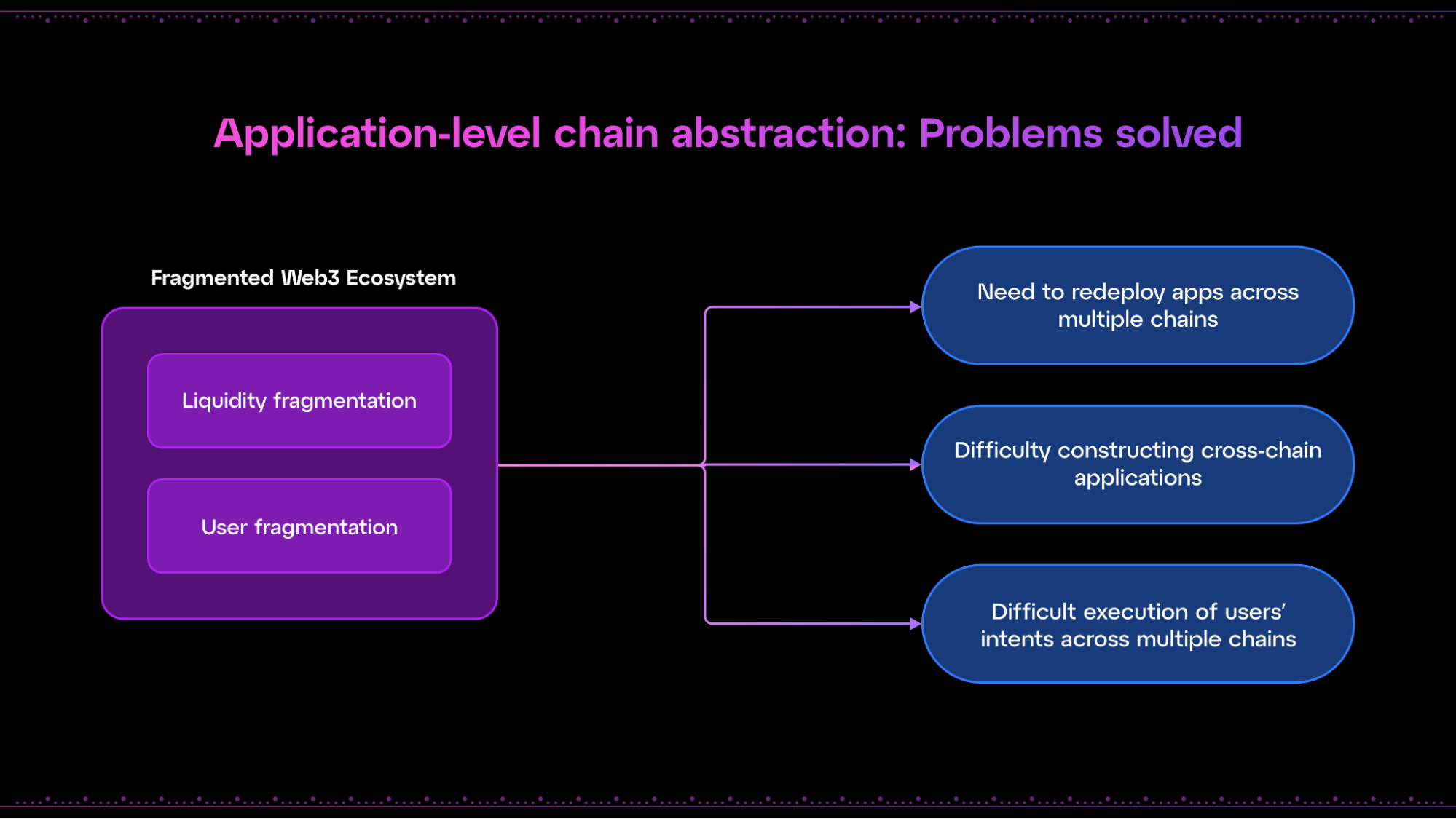

At the top layer, the application level focuses on making it easier for developers. Instead of having to write code specifically for each blockchain, developers can use tools that let them build one app that works and composes across multiple chains. For example, using platforms like Agoric or Socket Protocol, a developer can create a DeFi app that automatically picks the best chain for each transaction based on fees, speed, quotes, etc. This means developers can spend less time worrying about the nitty-gritty details of each chain and more time building cool features.

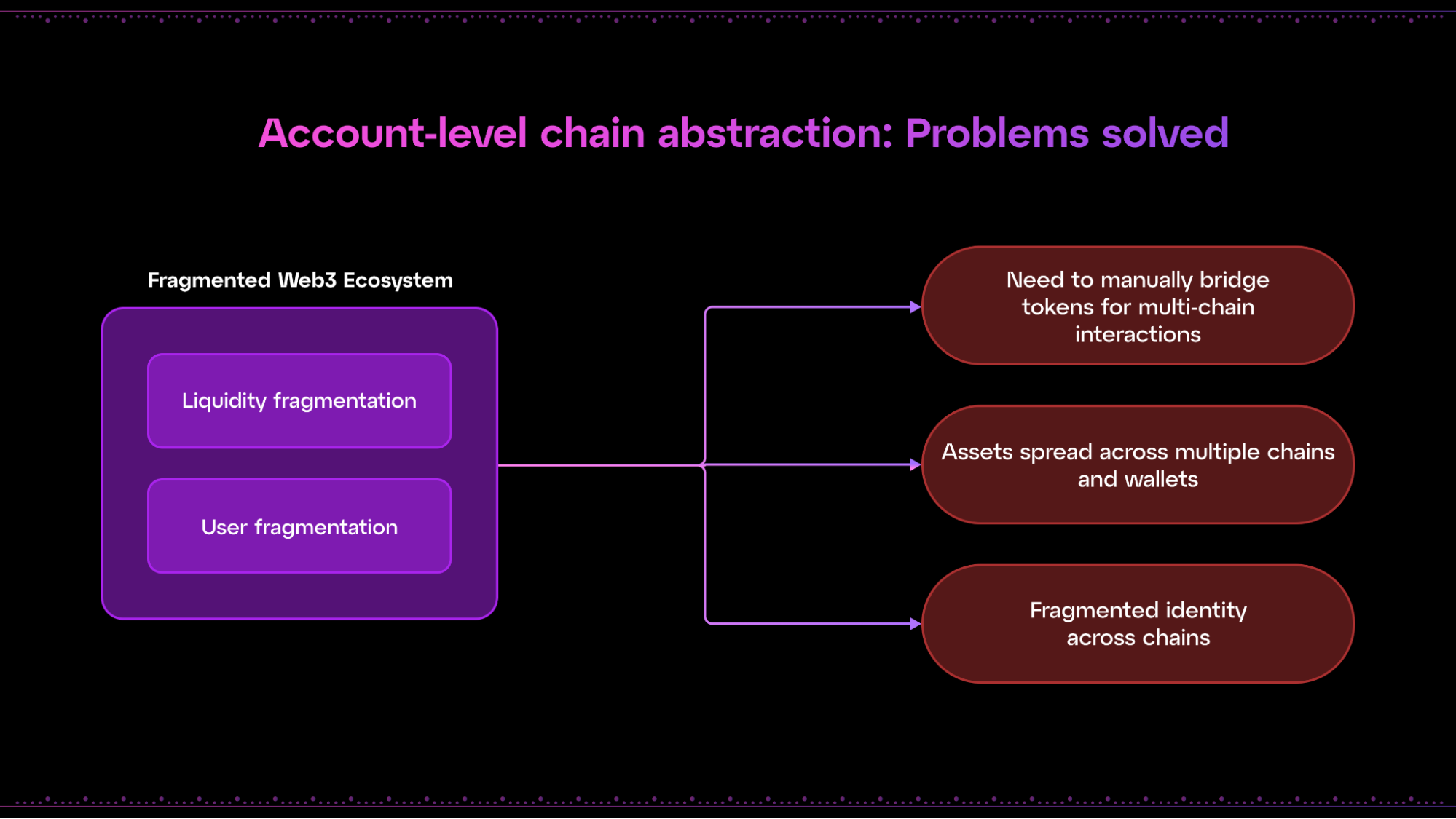

The next layer down is the account level, which is all about making things simpler for users. The idea here is to give users a single account or wallet that works across all the different blockchains. Imagine being able to deploy your assets across various chains without worrying about manually managing each one.

Here’s how it works:

-

Unified Balances: It brings together your balances from different chains into one place, so you don’t have to juggle multiple accounts.

-

Automated Gas Payments: No more stressing over paying gas fees on each chain; this layer handles it for you.

-

Single Identity: You get a single identity or access point that works across all participating chains.

For instance, with something like Particle Network’s universal accounts, you could use the same account to interact with a DeFi app on Ethereum, play a game on Solana, and join a DAO on Polygon, all without switching wallets or moving your assets around. It’s a much smoother experience and way easier for newcomers to get into.

The account level layer addresses the opportunity cost variable of my thesis that I explained earlier in this research article. This is where Particle Network fits in. Their Universal accounts help minimize the opportunity costs associated with holding multiple assets across multiple chains.

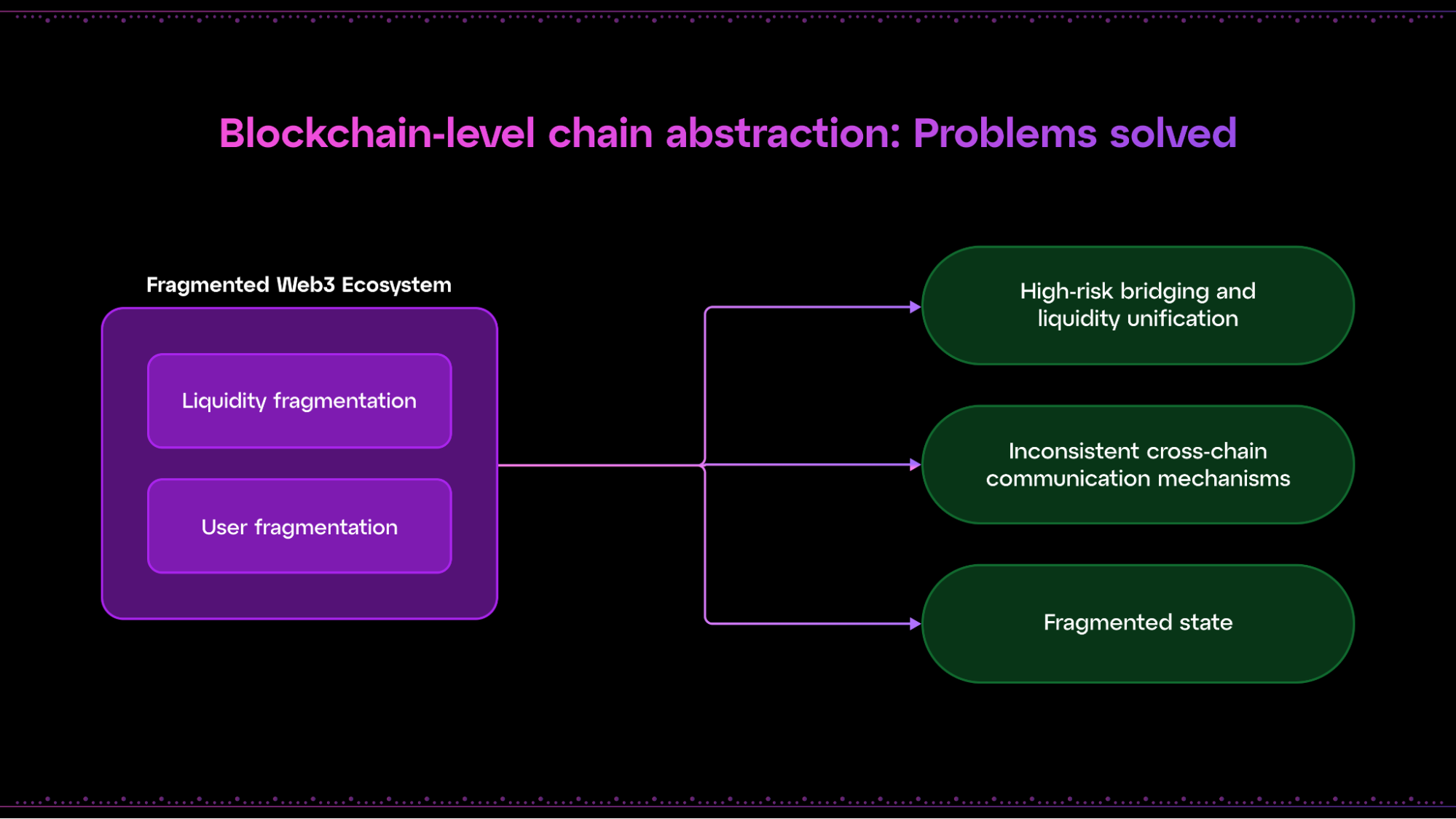

At the base, you’ve got the blockchain level, which is like the foundation holding everything together. This layer focuses on making sure all these different blockchains can talk to each other and share information securely.

Take Optimism’s Superchain which connects multiple L2s so they can share security and move assets between them easily. Or the Inter-Blockchain Communication (IBC) Protocol in the Cosmos ecosystem, which lets different blockchains work together seamlessly. This means you could stake tokens on one chain and use them on another without needing to mess around with bridges or complex processes, and finally Polygon’s AggLayer and Avalanche Subnets. These networks have unified communication standards and shared properties that make interoperability far more efficient than between traditional, separate blockchains.

Together, these three layers aim to make the blockchain world more connected and easier to use. Imagine using a DEX built on this stack. The DEX would automatically find the best chain to execute your trade, let you manage everything from one wallet, and ensure your assets move securely across different chains. This approach could solve a lot of the fragmentation issues we see today and make blockchain much more accessible to everyone. The ultimate goal is to make using blockchain as easy and intuitive as using the internet, without all the technical headaches.

The multi-layer framework is all about showing how a fully chain-abstracted experience can come together when different solutions work across multiple levels.

-

At the blockchain level, you’ve got built-in interoperability between certain chains.

-

Then, at the account level, users can see and manage all their assets across these chains from one place.

-

Finally, at the application level, developers can build apps that work smoothly across different chains without the user having to worry about the complex tech behind it.

We can use this framework to help make sense of the projects out there that are working on chain abstraction. It helps to categorize solutions based on which part of the stack they’re addressing and shows how they can fit together to create a completely chain-abstracted ecosystem.

Enter Particle Network

Particle Network has had quite an evolution. They started out by focusing on improving the Web3 user experience, realizing that the current onboarding process—like downloading MetaMask and dealing with seed phrases—was way too complicated for most people. Their first product was a "wallet as a service," which made it possible for users to log into Web3 apps using their social media accounts or email addresses instead of going through the usual hassle.

As they grew, Particle Network introduced account abstraction, which brought in gasless transactions to make things even smoother for users. But they soon realized that despite these improvements, interacting with different blockchains was still a pain for users.

This led them to pivot to chain abstraction. The goal here is to make using multiple blockchains as simple as possible, with users having just one account and balance that works across any blockchain.

Particle Network's approach to implementing chain abstraction is built around the concept of Universal Accounts. These accounts are coordinated and validated through a decentralized Cosmos chain, rather than relying on something like a centralized server. This approach aims to maintain high security standards while enabling the seamless cross-chain functionality that chain abstraction promises.

Before I discuss the architecture of Particle Network, let’s explore the key features of Particle Network:

Universal Accounts:

Universal Accounts are at the heart of Particle Network’s chain abstraction strategy. They give you a single address and balance that works across the entire multi-chain Web3 ecosystem. The idea is simple: one account, one balance, usable on any blockchain.

Key Features of Universal Accounts:

-

Unified Balance: Your balance and account state are consistent across all blockchains.

-

Fund Pooling: Need funds for a transaction? They’ll pull from your balance across multiple chains to get the job done.

-

Seamless Experience: You can deposit and use funds on any blockchain, and it’ll feel like you’re using just one.

Universal Accounts work by attaching an ERC-4337 smart account to your existing Externally Owned Address (EOA). When you interact with a dApp using Particle’s SDK, you’re assigned or linked to a Universal Account connected to your EOA, making this account your main point of interaction across any app using Particle’s tech.

Imagine you want to stake ATOM on Cosmos, but all your funds are sitting in USDC on Ethereum. Normally, you’d have to jump through a bunch of hoops:

-

approve a DEX contract,

-

swap USDC for ETH,

-

bridge that ETH over to Cosmos,

-

swap it for ATOM, and

-

then finally stake it.

But with a Universal Account, you can forget all that hassle. All you’d need to do is sign one transaction, and the system handles everything else for you, making the whole process way easier.

Implications:

-

Simplified User Experience: Users no longer need to manage multiple addresses or constantly bridge assets between chains.

-

Increased Adoption Potential: By abstracting away blockchain complexity, this could significantly lower the barrier to entry for new users in the Web3 space.

-

New DApp Possibilities: Developers can create applications that seamlessly operate across multiple chains, opening up new possibilities for cross-chain DeFi, gaming, and more.

Universal Liquidity

Universal Liquidity powers these accounts, enabling smooth, atomic cross-chain transactions and keeping your balance unified. It makes sure that funds move seamlessly across chains, so you can use your assets wherever you need them.

Key Aspects of Universal Liquidity:

-

Cross-Chain Funds Movement: It automatically handles moving your funds across chains when needed for a transaction.

-

Automatic Fund Sourcing: Don’t have enough funds on one chain? It’ll pull from your balances on other chains.

-

Bridge-Free: No need to manually bridge tokens between chains.

With Universal Liquidity, interacting with different blockchains feels like using just one. The necessary liquidity for any action is sourced from your Universal Account’s balances across chains, and any required swaps are executed automatically.

Now, picture this—you’re eyeing a rare Farcaster NFT on Base, but your funds are in AVAX on Avalanche. Usually, you’d have to manually swap, bridge, and transfer funds across different chains to make the purchase. But with Particle Network’s Universal Accounts and Universal Liquidity, you just sign one transaction. The system handles all the complicated steps behind the scenes, moving your AVAX from Avalanche to Base, swapping for the right tokens, and buying the NFT, all without you lifting a finger.

Implications:

-

Capital Efficiency: Users' assets become much more liquid and usable, as they're not siloed on individual chains.

-

Complex DeFi Strategies: This could enable sophisticated cross-chain DeFi strategies that were previously impractical due to the friction of moving assets between chains.

-

Potential for Centralization: While the system aims to be decentralized, the complexity of cross-chain coordination could lead to some degree of centralization in practice.

Universal Gas

Universal Gas, or gas abstraction, tackles the problem of having to deal with different gas tokens for transactions across blockchains. It lets you pay transaction fees with any token from any chain.

Key Features of Universal Gas:

-

Cross-Chain Payments: Pay fees on one network using tokens from another (e.g., use USDT from Base to pay fees on Arbitrum).

-

Flexible Payment: Choose the token you want to use for gas fees when making a transaction through a Universal Account.

-

Automatic Conversion: Part of the fee is automatically converted into Particle Network’s native token, PARTI, to finalize the transaction on their network.

Universal Gas eliminates the hassle of bridging tokens or maintaining separate gas token pools for different networks. It simplifies things by letting you pay fees with whatever token you have on hand.

Let’s say you want to interact with a smart contract on Arbitrum, but you’ve only got BNB on Binance Smart Chain. Instead of having to buy ETH for gas fees, you can just use Universal Gas. You pick BNB to pay the gas fee, and Particle Network’s system does the rest—it converts your BNB into the necessary gas tokens and settles the transaction on Arbitrum. You don’t need to worry about holding ETH or juggling multiple tokens for gas fees—the system takes care of it all in the background.

On Particle Network's testnet, there’s even a Universal Gas Token called "USDG" that you can use after depositing various other assets.

Implications:

-

Improved UX: Users can interact with any supported blockchain without needing to acquire its native token first.

-

Potential for Gas Tokenization: This could lead to interesting models where gas fees become more predictable and potentially even tradeable as derivatives.

-

Economic Complexities: The system introduces new economic dynamics, potentially affecting demand for native tokens and introducing new arbitrage opportunities.

These three components—Universal Accounts, Universal Liquidity, and Universal Gas—work together to create a smooth, chain-agnostic experience in the Web3 world. They remove the complexities of dealing with multiple blockchains, making it feel like you’re interacting with a single, unified system.

Here’s me interacting with my Universal Account to send a test transaction from Optimism to Base, which took less than 4 seconds to execute. Verify the transaction from the hash here:

If you haven’t already checked out what Particle Network’s Universal Account looks like in action, I’d highly recommend visiting Particle’s Pioneer campaign or their recent demo video.

Architecture

Particle Network's architecture is built on a modular Layer 1 (L1) blockchain using Cosmos SDK that breaks down different infrastructure components into separate modules.

At the core of this architecture is a custom Cosmos app chain that serves as the backbone of the entire system. The app chain is responsible for verifying and settling all operations initiated by Universal accounts. When a user wants to perform an action that involves multiple blockchains, this app chain steps in to coordinate the entire process. It breaks down the user's request into multiple sub-operations, each targeting a different blockchain, and ensures that these operations are executed correctly and in the right order.

Here’s how it’s structured:

-

Master Keystore Hub: This is the core component, acting as the main point of coordination for deploying and updating smart contracts across all networks. It keeps everything in sync, like settings and modules, across each instance of a Universal Account. The account settings are stored on Particle Network and are used to ensure everything stays consistent across different networks. The L1 layer handles cross-chain communication, whether it’s deploying new instances or updating existing ones.

-

Decentralized Messaging Network (DMN): This network is made up of Relayer Nodes that use a native Messaging Protocol. These nodes keep an eye on whether UserOperations on external chains are completed successfully and then report back to Particle’s L1, updating the system. Basically, the Relayer Nodes monitor what’s happening on other chains and make sure the network is up to date.

-

Decentralized Bundler: Unlike the centralized bundlers seen in current ERC-4337 implementations, Particle Network’s Bundler network is fully decentralized. It’s designed to handle high volumes of cross-chain UserOperations. Node operators running these Bundler nodes are the ones who kick off and execute these operations on external chains.

A standout feature of Particle’s setup is how it handles Data Availability (DA). Instead of sticking with just one DA solution, they use an Aggregated Data Availability (AggDA) model, pulling together multiple DA providers like:

-

Celestia

-

Avail

-

NEAR DA

The AggDA system operates in one of two modes for each block: either random deterministic redundancy or selective conditional publishing.

-

In the first mode, data is randomly but deterministically spread across multiple DA layers, increasing availability and redundancy.

-

In the second mode, specific conditions determine which DA layer is used, optimizing for efficiency.

Particle Network's dual consensus mechanism is another area where they've innovated. This approach is designed to mitigate the risks associated with bootstrapping a new Proof-of-Stake network. In a typical new blockchain, if the entire validator set is secured only through the network's native token, any volatility in that token's value can impact the network's stability.

For consensus and network security, Particle Network uses a dual staking model. This involves two separate pools of Validators:

-

One pool secured by Particle Network’s native token ($PARTI).

-

Another pool secured by Bitcoin (BTC) through Babylon.

In this dual staking system, both groups of validators are required to independently agree on the validity of transactions and blocks. This ensures equal participation in the consensus process from both groups. By leveraging the established economic security of BTC alongside their native token, Particle Network reduces the pressure and security dependence on $PARTI, especially in the early stages of the network's life. This approach allows them to bootstrap the network's security using the well-established crypto-economic security provided by BTC staking.

Competitive Landscape

Near Protocol: NEAR makes cross-chain interactions straightforward and user-friendly with its Chain Signatures feature, allowing account holders to execute transactions on other blockchains like Ethereum or Bitcoin. By using an MPC Network for secure cross-chain transactions and a Multichain Gas Relayer to handle gas fees across different chains, NEAR removes the complexity of managing multiple accounts. The goal is to simplify cross-chain operations, making it easier for users to navigate various blockchains.

Xion: XION is developing a "Generalized Abstraction" layer aimed at creating a smoother Web3 experience. Key features like Meta Accounts (similar to Universal Accounts), cross-chain interoperability, and seamless dApp interactions are all integrated at the protocol level. XION’s goal is to provide a unified interface where users can interact with multiple blockchains without needing to worry about the technical details behind the scenes.

One Balance: OneBalance focuses on simplifying multi-chain asset management through its "Credible Accounts" system. This feature gives users a consolidated view of their assets across various blockchains, handles gas fees automatically, and enables cross-chain transactions with ease. By using resource locks to manage asynchronous state transitions, OneBalance ensures a smooth experience without issues like double spending, all while avoiding the need for immediate on-chain finality.

Socket Protocol: Socket Protocol is developing comprehensive chain abstraction solutions through two main initiatives. Their Magic Spend++ smart wallet framework simplifies asset management across blockchain rollups by introducing a Chain Abstracted Balance (CAB), enabling cross-chain transactions with a single signature. This is to create the "first chain abstraction protocol" to streamline interactions across multiple blockchains. Using Modular Order Flow Auctions (MOFA) function, it abstracts away complexities like RPC endpoints, gas fees, and chain-specific details, allowing users to interact from a "global blockspace perspective." While they just released their whitepaper, Magic Spend++ smart wallet would arguably be just one of the applications built on top of Socket Protocol.

LiFi: LiFi has been refining chain abstraction within the DeFi space for around three years, focusing on aggregating liquidity from various DeFi platforms and blockchains. By doing this, LiFi enables users to access liquidity from multiple sources without needing to interact with each platform or blockchain individually. This approach simplifies the DeFi experience by removing the complexities of dealing with multiple protocols and chains.

These six tackle chain abstraction from different angles:

-

NEAR leverages its existing ecosystem to extend functionality across chains.

-

Xion builds a generalized abstraction layer at the protocol level.

-

One Balance focuses on simplifying multi-chain asset management and transactions.

-

Socket develops modular solutions for both wallet and protocol-level abstraction.

-

LiFi specializes in aggregating DeFi liquidity across multiple platforms and chains.

-

Particle Network creates universal accounts with seamless cross-chain interactions and liquidity.

Final Thoughts

Chain Abstraction is not just a narrative anymore. As an industry we are taking a significant leap forward in addressing the fragmentation challenges of the current (extended) blockchain ecosystem.

Even though there are definitely challenges to overcome, the potential benefits of chain abstraction are huge. If it works out, it could open up a whole new world of blockchain interoperability, where assets and data move smoothly across different chains. Users would be able to interact with decentralized apps without having to worry about or even understand the blockchain tech behind it all.

If you haven’t checked out what Particle Network’s Universal Account in action, I’d highly recommend visiting Particle’s Pioneer campaign.

References

Disclaimer

This article represents my personal analysis and thoughts on chain abstraction and Particle Network. While based on research and publicly available information, the views expressed here are entirely my own and do not directly represent the interests, official stance, or future plans of Particle Network or any other mentioned entities. Readers should conduct their own research and due diligence before making any decisions based on the information presented in this article.